Most successful Merchant Services Agents and ISO’s know how easy it is to develop tunnel vision, chasing non profitable accounts without knowing it. So, how do you know if that’s happening to you?

From dealing with a rapidly attriting collection of merchant accounts to personal and professional life changes, check out Velocity Funding’s seven signs that your merchant portfolio needs valuation services as soon as possible.

Does Your Merchant Portfolio Need Valuation Services? 5 Vital Signs

1. You’ve Never Had a Merchant Portfolio Valuation

A credit card processing portfolio is often the result of years of dedication and hard work. Because of that, it’s easy for an independent sales organization (ISO) or sales agent to forget the importance of having another person or company look over their portfolios.

Regardless of your knowledge about merchant services, your merchant portfolio needs valuation services if this has never occurred. Your first valuation and another’s perspective could yield insights into your portfolio’s untapped potential. It can also reveal hidden inefficiencies, helping you further streamline how you manage your portfolio for maximum profitability.

Without it, you may remain unaware of hidden risks, key trends, and other crucial information. Even if you have a good handle on your portfolio’s performance, a professional valuation could help you uncover previously unknown information.

2. You Need to Raise Cash for Professional and Personal Reasons

Whether it’s for growing your business, marriage, divorce, retirement, or another personal or professional life change, having someone valuate your portfolio ensures your current merchant portfolio value is sufficient to meet your needs.

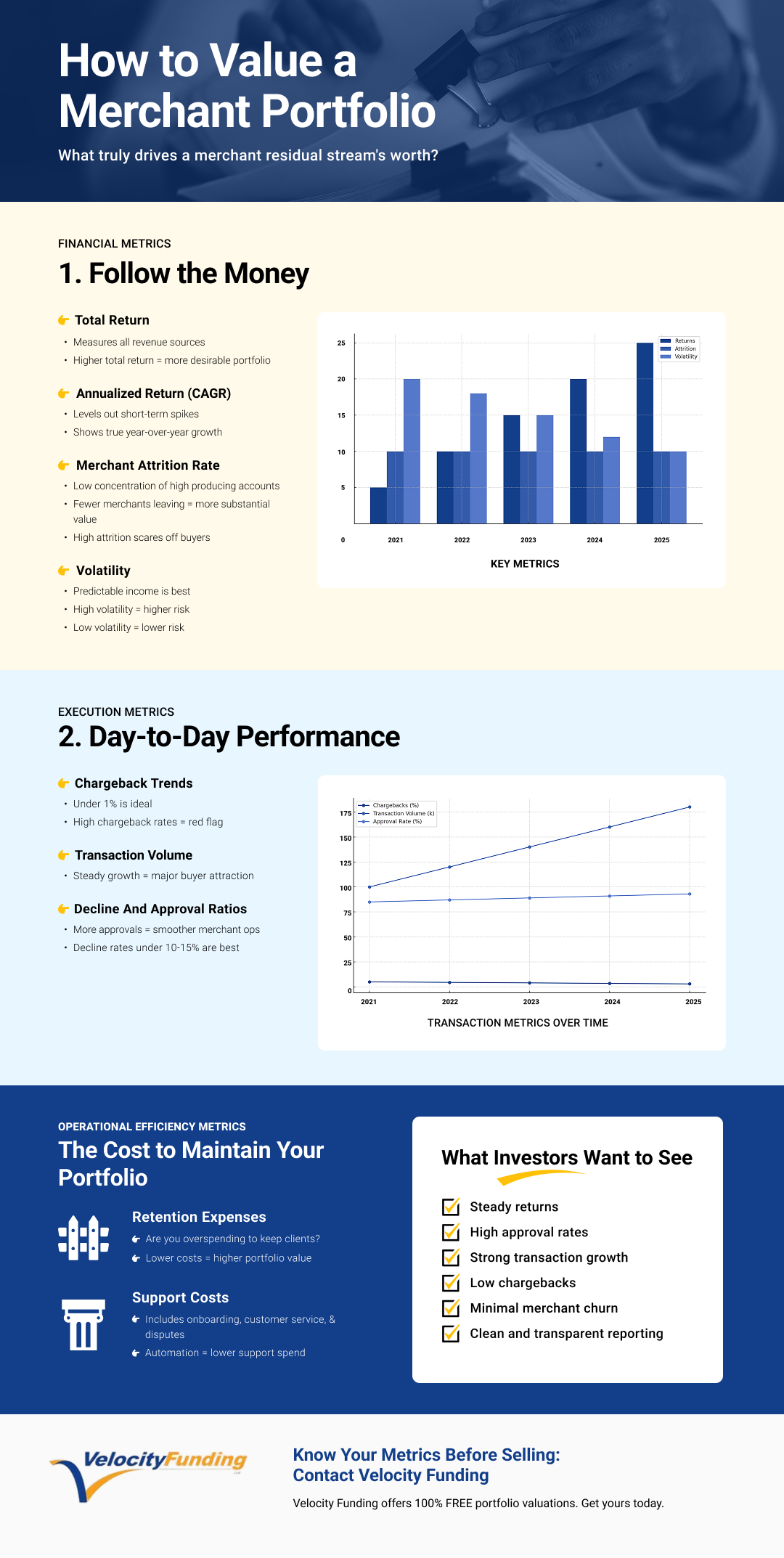

3. Learning what Merchant Portfolio Buyers are Looking for When Selling your Merchant Accounts

An evaluation of your merchant portfolio will give you insights into what purchasers look for when buying your merchant portfolio. Attrition is always an important metric but looking at the causes of attrition is really what buyers focus on. High margin accounts, $0 volume accounts and other factors could be priced differently than other merchant accounts. Other factors like POS systems and gift card services make an account more “sticky” and less likely to cancel their merchant services contract. The only way to know is to have a valuation done by a company that buys merchant portfolios.

4. Your Profile Has a Zero Growth Rate

Buyers of Merchant Portfolios assume a zero growth rate. Your merchant portfolio is most likely growing because you are adding new merchant accounts. A buyer will not be adding to your portfolio, therefore in their view it is static. By adding new merchants to a portfolio Agents do not realize their actual attrition. A regular valuation will inform the Agent or ISO the actual attrition numbers and what type of merchant accounts were causing the drop in revenue or sales.

Velocity Funding analyzes past trends, future projections, and other vital factors in our free portfolio valuations. To save time and avoid the headaches of evaluating accounts accurately, choose Velocity Funding when your portfolio needs valuation services. We’ll help you drive strategies leading to meaningful, consistent growth.

Get Your FREE Portfolio Valuation

5. You’re Unsure About the Risk of Your Portfolio

Your Merchant Portfolio is only valuable because of its potential future residual income. Potential income from a merchant account is zero if they cancel. It is therefore beneficial to remove some or all of this cancellation risk by getting an evaluation and selling the merchant accounts. A professional valuation lets a skilled person assess your portfolio’s risk exposure. They can also provide recommendations to help you avoid being over-leveraged with high-risk merchants or industries.

Why Are Portfolio Valuations Beneficial?

Irregular portfolio evaluations can be costlier than you think. We’ve covered when your portfolio needs valuation services. Let’s now look at what makes these services beneficial.

Making Informed Merchant Portfolio-Related Decisions

Valuations provide crucial insights that can help you make smarter decisions. Whether you want to sell your portfolio and exit this industry or grow it as much as possible, valuations can guide your choices immensely.

Adhering to Ever-Changing Regulatory Requirements

Portfolios need valuation services for reasons besides residual growth. It’s also imperative to ensure you’re keeping up with regulatory-related changes. The new trend to sign accounts that push the cost of merchant services onto the consumer in the form of a cash discount or surcharging is hated by the networks. Visa Mastercard, Discover and AMEX and the Government continue to squeeze the merchant processing agents by capping the total amount that can be charged by the Agent. A portfolio that has many consumer surcharge accounts could see margins be dramatically reduced as the cap on the surcharge percentage that is allowed is reduced. The networks also impose stiff penalties on accounts that do not comply with all of the regulations. This problem is lurking in many merchant portfolios.

Having an expert look over your portfolio regularly can help you avoid non-compliance-related penalties and punishments.

Mitigating Risk

Risk is impossible to avoid as a Credit Card Processing Agent. . However, taking on too much risk could lead you to wake up to considerable unexpected losses. Fortunately, portfolio valuations let a qualified professional immediately detect and report potential risk areas. Responding quickly to these risks could help avoid leaving lots of residual income on the table.

As you’ve learned, every successful portfolio needs valuation services. A proper valuation can help reposition your merchant account to add value to your merchant portfolio and prepare for potential personal and professional life changes.

Expert guidance from Velocity Funding can keep your portfolio optimized all year round while ensuring you stay compliant and poised for long-term growth. Schedule your free valuation today. Take control of your portfolio’s future.

Get Your FREE Portfolio Valuation