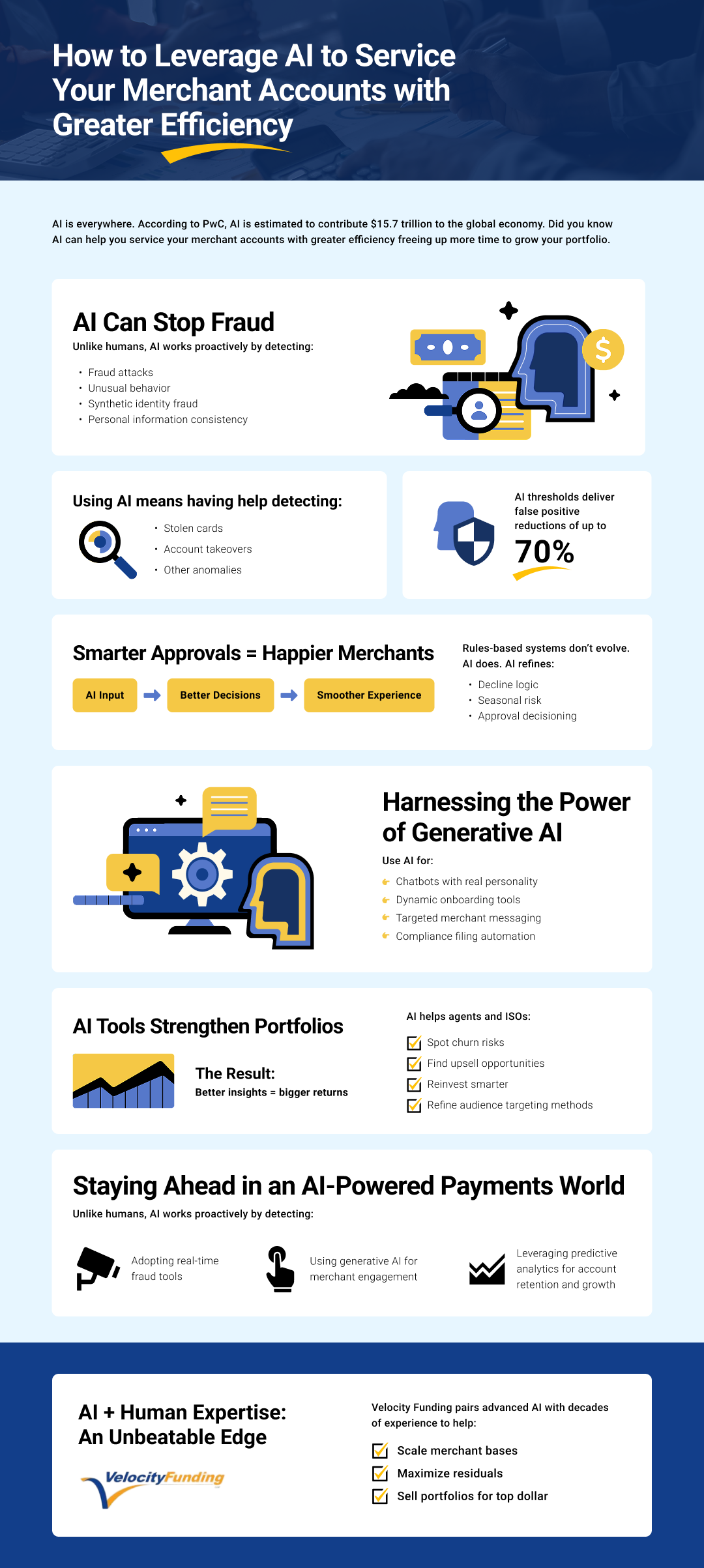

Industries worldwide are rapidly adopting artificial intelligence (AI). In the payment industry, AI does much more than speed up existing processes. For merchant services agents and Independent Sales Organizations (ISOs), using AI isn’t only about leveraging new technology—it’s about forming unbreakable bonds with merchants, protecting portfolios, and guarding against fraud.

In this post about leveraging AI in the payments industry, we’ll cover:

- How AI helps fight against fraud with real-time detection and prevention

- The ways AI helps streamline approvals and declines

- How generative AI is shaping the future of merchant services

- How AI investment tools strengthen portfolios

- Crucial AI considerations for payment companies looking to stay competitive

Real-Time Fraud Detection and Prevention

While the payments industry evolves rapidly, some of its threats persist. One such danger is fraud. Every transaction carries a potential threat, including the use of a stolen card or a complete account takeover. Historically, fraud detection has been a manual and slow process. Leveraging AI in the payments industry can help change that.

One aspect that makes AI so special is its ability to analyze patterns across massive amounts of data. For instance, a trained AI model can identify transaction-related anomalies much more accurately and efficiently than humans can.

Using these models safeguards processors and protects the portfolios of agents and ISOs, helping to avoid costly chargebacks while maintaining strong merchant relationships.

Streamlined Approvals and Smarter Decline Logic

Leveraging AI can also revolutionize how businesses in the payment industry make decisions. Rules-based systems are notorious for being either too approval-friendly or too aggressive in their decline. Either situation can result in lots of frustration for processors, merchants, agents, and ISOs.

AI learns and adapts to user behaviors, fine-tuning its ability to improve transaction approval rates by distinguishing legitimate transactions from suspicious or fraudulent ones. When AI does its job well, everyone wins. Merchants and customers enjoy faster approvals combined with fewer frustrating false declines. When that happens, agents and ISO stay happy as their portfolios remain healthy.

Additionally, AI systems can adjust risk thresholds dynamically based on unique conditions. An example could be having an AI model optimize approval settings in a way that avoids false declines without letting fraud run rampant during the holiday season.

The Role of Generative AI in the Payment Industry

So far, you’ve learned how the payment industry leverages AI to help process transactions. At the same time, generative AI is starting to reshape other aspects of the payment ecosystem. Rather than analyze data, this type of AI can generate new content and workflows. It can even create images, audio, and videos.

How is the payment industry utilizing this form of AI?

- Intelligent and Realistic Chatbots: If you or merchants have felt frustrated with chatbot results in the past, AI has brought this digital tool forward by leaps and bounds. Companies can now utilize chatbots to engage in realistic and naturally flowing conversations, rather than relying on generic responses.

- Keeping Companies Compliant: Human errors can be particularly troublesome when they lead to compliance-related mistakes. However, AI can provide dependable assistance with ongoing monitoring requirements, form filing, and regulatory-related reports in the payments industry.

- Generate Better Onboarding Experiences: A significant challenge all industries face is making onboarding experiences more engaging. Leveraging AI can create dynamic onboarding experiences for merchants, including customized educational materials, checklists, and other relevant resources.

- Personalizing Marketing Efforts: In addition to personalizing onboarding experiences, generative AI can also automate many aspects of content creation. Instead of manually writing blog posts, ads, and emails for each client, AI can save time generating content that resonates with audiences from all walks of life.

- Helping With Outreach Efforts: Generative AI is also useful for hyper-focused outreach based on a merchant’s stage in their business lifecycle. In this way, your business and its AI tools may anticipate merchants’ needs before they do.

Using AI Investment Tools for Agents and ISOs

No discussion about AI use in the payment industry is complete without highlighting the immense help it can provide with investing. Merchants and ISOs can harness the power of AI to automate in-depth analysis of merchant behaviors and transaction histories, generating a wealth of insights.

Companies in the payment industry are leveraging AI to:

- Identify risk factors for churn, stopping merchants before they stop being customers.

- Find ways to do the most with marketing dollars.

- Find customers ideal for upselling.

If you’re an agent or ISO considering selling your portfolio, AI investment tools can help you better understand the true value of your accounts. Velocity Funding combines the best of both worlds, using our decades of experience with cutting-edge AI insights to ensure sellers receive the maximum value for their portfolios.

Are You Ready to Leverage AI in the Payments Industry?

The world is evolving rapidly, thanks to the help of innovations like AI. From real-time fraud prevention to smoother approval processes and generative AI-driven customer support, AI empowers merchants, agents, and ISOs to perform their jobs more effectively while dealing with less confusion.

As companies strive to stay competitive, leveraging AI in the payment industry will no longer be optional—it will become necessary for those seeking to maintain merchant trust, stay ahead of the curve, and maximize residual income.

Whether you’d like to maximize the worth of your portfolio and residual income or you’re ready to sell, Velocity Funding is your trusted partner in the payments industry.